Article via https://www.renofi.com/blog/projecting-the-value-of-homes-in-the-us-in-2030-analyzing-the-impact-of-covid-19/

One of the most common reasons for home renovations is the positive impact that they can have on the value of your home.

Taking out a home renovation loan can be a real investment in your future.

And one of the main considerations when planning home renovation work is a home’s future value.

In fact, there’s no ignoring that the right renovations and additions can add big bucks onto what a property is worth, and that’s just looking at the value that’s added today.

But house prices ultimately change over time, and by using historical trends from the last decade to project these forward by ten years, we can start to see what long-term changes could look like, as well as how investments made in your home today could increase the returns in years to come, as house prices continue to rise.

But let’s not ignore the current pandemic and the way that it’s impacting both property prices and the way that we’re rethinking what we want from our homes.

We’re doing a deep dive into the projections of how much it could cost to buy a home across the US by 2030, as well as the impact that COVID-19 has had on real estate markets in each state and the country’s 50 biggest cities.

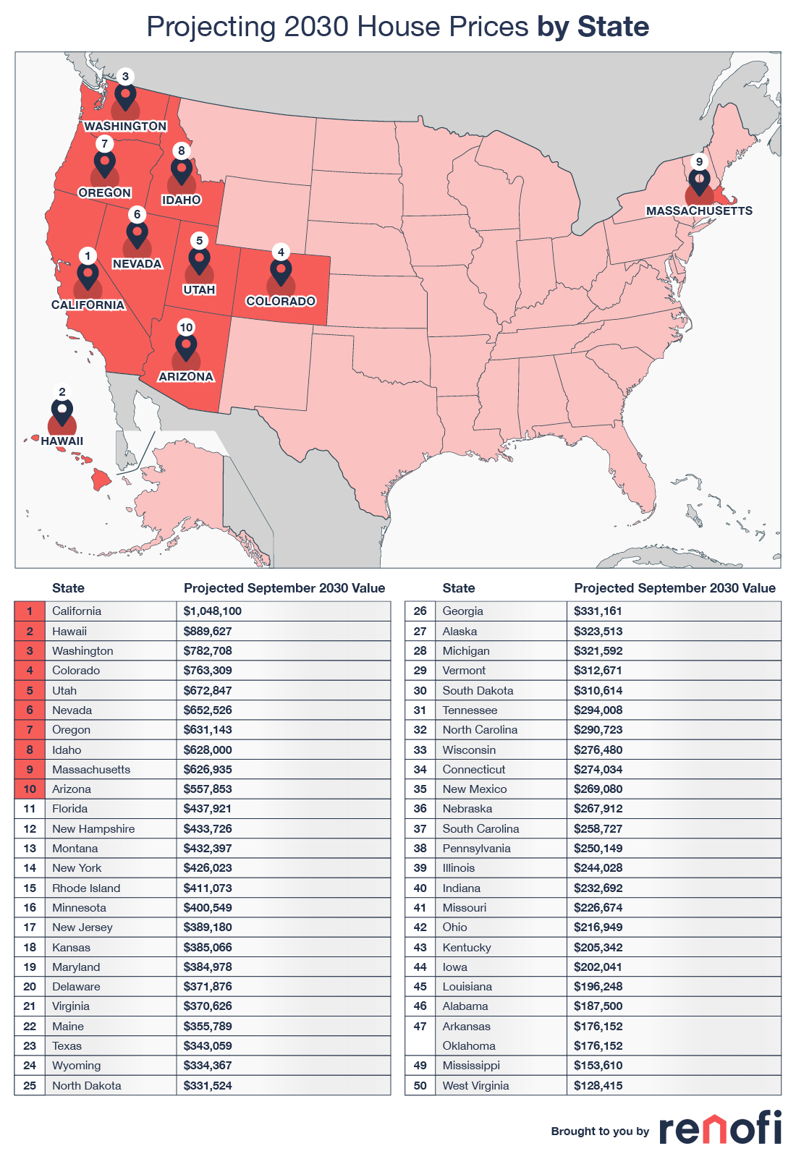

The Average US Home Could be Worth $382,000 by 2030

House prices in the US have risen by 48.55% in the last ten years (from $173k to $257k) and if they continue to grow at this rate for another decade, the average US home will be worth $382k by 2030.

But across such a vast country, the picture inevitably varies.

To give an example, in Nevada, house prices have more than doubled since 2010 (105.84%), while in Connecticut, the average price has increased by just 1.12% over the same period.

So then, if house prices continue to increase at this rate over the next ten years, how would the average house price look across the nation?

The state where house prices are predicted to be the highest by 2030 is California, where the average home could top $1 million if prices continue to grow at their current rate.

Other states expected to see their average house price rise above the $750k mark include Hawaii, Washington and Colorado.

Then when we look at how 2030 prices could look in America’s 50 most populated cities, it’s not a surprise to see that six of the top ten most expensive cities are located in California.

In fact, prices in two cities, San Francisco and San Jose, are actually projected to reach an average of more than $2 million if they continue to increase in value at the same rate.

Prices in six other cities could rise above $1 million – Oakland, Seattle, Los Angeles, San Diego, Boston, and Long Beach.

The Impact of COVID-19 on the Value of Homes in the US

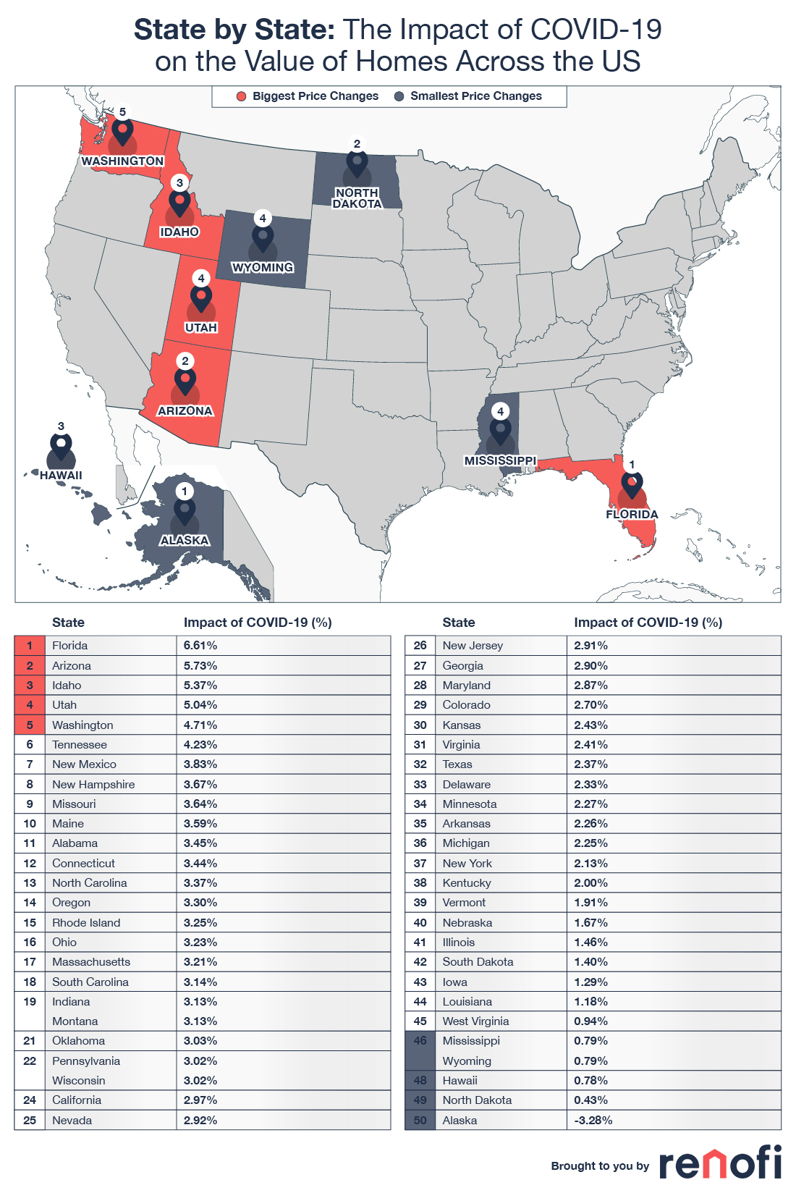

The outbreak of COVID-19 has had an unbelievable impact on all areas of our lives and the economy at large, but how have house prices changed since the pandemic started?

We’ve taken a deep dive into home value data to analyze the impact that has been seen across the country.

And, on the whole, we can reveal that house prices have continued on their pre-pandemic upward trajectory, rising by 2.80% from $250k in March, to $257k in September.

More than ever before, people are spending a significant amount of time in their homes, and this has given them the time to think about what they really want from their space.

For some, this means that renovations and remodeling are currently in the pipeline on their current property. but For others, it means finding their forever home and making it just right; whatever that takes.

Of course, there’s another factor to consider here, and that’s the strong shift in attitudes toward the workplace and remote working. Many are now realizing that they don’t need to live so close to their workplace and are moving out to the suburbs.

And it’s this renewed interest in our homes, due to the pandemic, that has kept prices on the up.

But, looking at the bigger picture, how has the housing market reacted throughout the course of the pandemic around the country by state and in our major cities?

In Florida, property prices have risen by 6.61% in the months since the President declared a national emergency. Arizona, Idaho, and Utah have all seen increases of more than 5%.

On the other hand, Alaska is the only state where house prices have dropped over the last six months, seeing a decline of 3.28%.

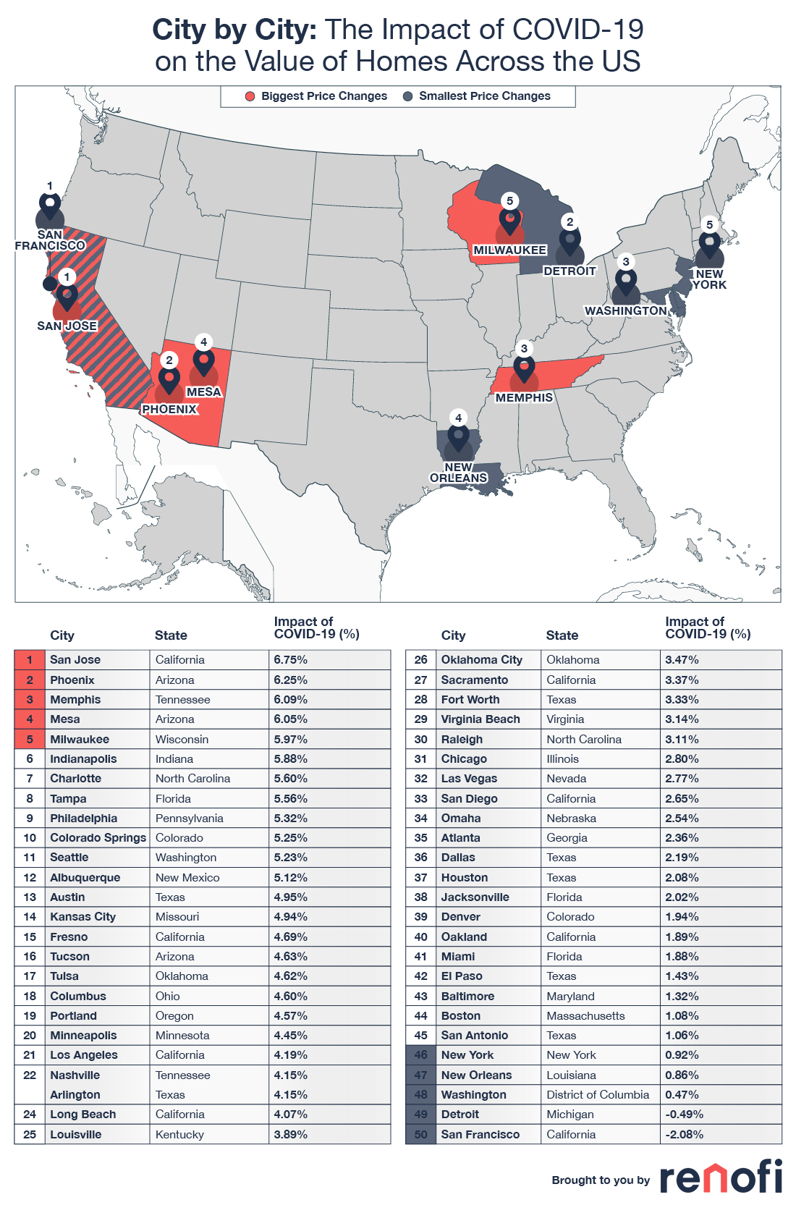

Interestingly, the few cities to see a drop in prices following the pandemic were amongst the biggest in the country, with San Francisco seeing prices drop by 2.08% since March, while prices also stalled in New York City, rising by just 0.92% between March and September.

Again, this could be a by-product of the fact that millions of Americans are now working from home as a result of the coronavirus pandemic, leading many to leave behind their apartments in the cities and move to the suburbs.

Other cities that saw house prices stall include Detroit, Washington, D.C. and New Orleans, which again are highly populated cities.

However, it seems that COVID has had a limited effect on many other housing markets, such as in San Jose, where prices continued to rise at a rate of 6.75% in the last six months, followed by Phoenix, Arizona (6.25%), Memphis, Tennessee (6.09%) and Mesa, Arizona (6.05%).

Methodology

Average house prices were sourced from Zillow.

To estimate property prices in 2030, we took the average price in each state and the 50 most populated cities in the US for the present day (September 2020) and ten years ago (September 2010).

We then calculated the rate of change in values between the two dates and applied this rate of change to the average price in September 2020 to estimate how they might look in 2030, assuming that they continue on that same trajectory.

To show the effect of COVID-19 on house prices, we looked at how prices had changed between March 2020 (when the pandemic was declared a national emergency) and September 2020.